Skip in-person visits with online and mobile banking.

Scroll to explore the full suite of our online and mobile banking options, or click below to start setting up your account.

Combining the advantages of electronic tools with the personalized service only a community bank can offer.

Want to bypass stopping at a local Byline branch? Do the majority of your day-to-day banking securely from your computer.

Here’s just some of what you can do with online banking:

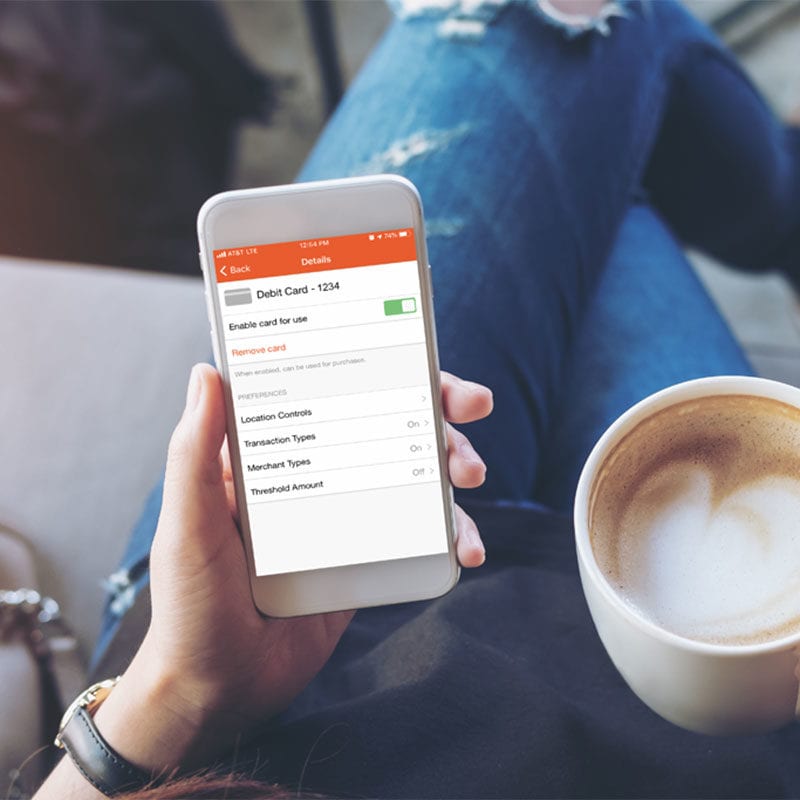

Already banking online with us? Download our mobile app to check account balances, deposit checks, and send money right from your smartphone or tablet.

Available in your Byline Bank mobile app, Zelle is a fast and easy way to move money between you and the people you know–no matter where they bank.

Securely send and request money with ease. Zelle even has a built-in calculator to make splitting the bill a breeze.

Shop in-store, in-app, or online using your Byline Bank debit card by pairing it up with your favorite digital payment option.

Digital wallets let you make purchases with your phone quickly and securely–no need to reach for your wallet or dig through your purse when you’re about to pay.