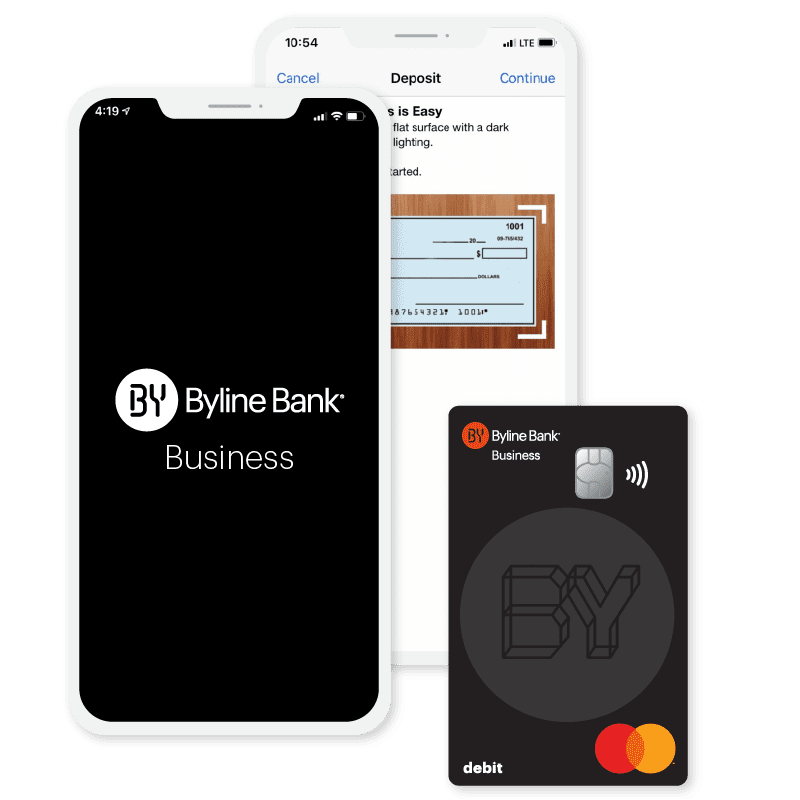

Business Online & Mobile Banking

Manage your business wherever, whenever with online and mobile banking. The Byline Business mobile app is available in the Apple App Store and the Google Play Store.

Complete everyday banking activities with ease by enrolling in Business Online Banking.

Check balances, make loan payments, transfer funds between accounts, verify deposits and more.

Set up ACH payments and collections, online bill pay, domestic and international wire transfers, and tax payments.

View enhanced reporting, paperless statements, 18 months of transaction history, and 4 years of check images.

For additional convenience, you can opt to include these features in Business Online Banking:

All the banking services your company needs, wherever you are.

Accepted everywhere Mastercard® is accepted. Get cash fee-free from our Byline branches or thousands of Allpoint® ATMs nationwide. Our debit cards put you and your employees in control.

Review the Mastercard Guide to Benefits for Small Business Cardholders for more information.

Manage your checking from anywhere with our comprehensive business mobile and online banking options. The Byline Business mobile app is available in the Apple App Store and the Google Play Store.